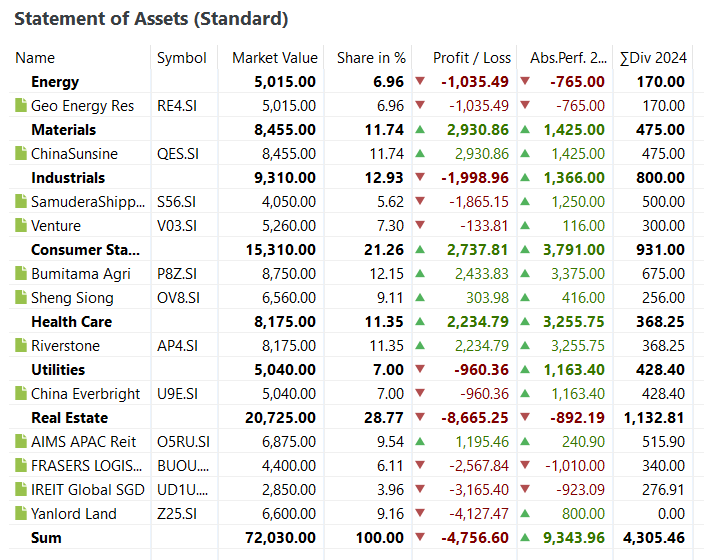

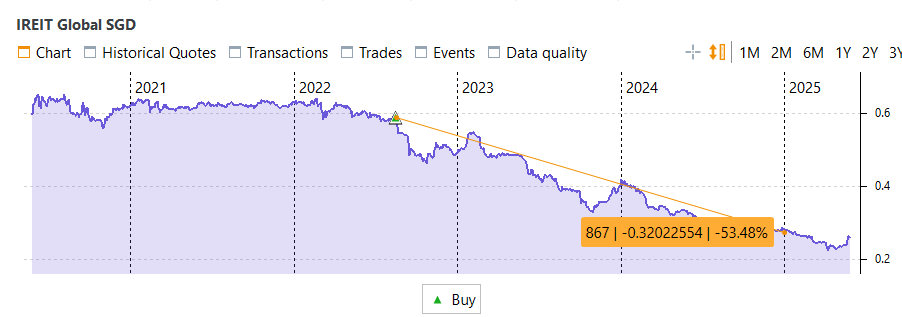

In comparison to 2023, my equity portfolio remains unchanged in 2024. Throughout the year, I was presumably experimenting with various football betting strategies in an attempt to find a quick cash return rather than holding out for dividends. Frasers Logistics and IREIT Global SGD experienced a significant decline in value, with Frasers Logistics falling to (-$2,567) and IREIT Global SGD falling to (-$3,165), respectively.

- The portfolio has not changed from 2023 to this time.

- The top three largest stock losses are Yanlord Land (-$4,127), IREIT Global SGD (-3,165) and FRASERS (-$2,567).

- Portfolio yield to market value = (4,305.46 / 72,030) x 100 ~ 5.98%

- Market value year 2022 to 2023 = (72,030.00 – 73,842.90) / 73,842.90 x 100 ~ -2.46%

- Dividend earned year 2022 to 2023 = (4,305.46 – 6,403.37) / 6,403.37 x 100 ~ -32.77%

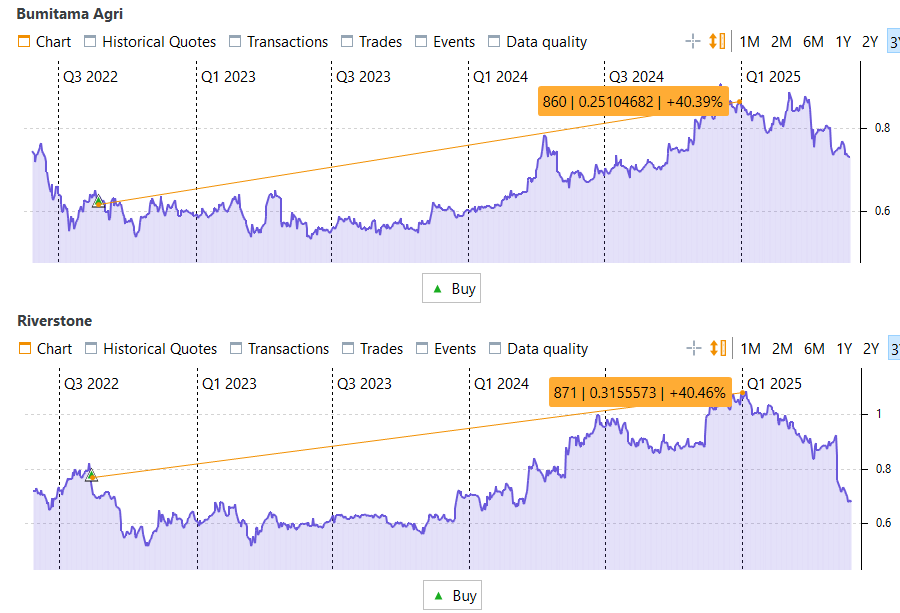

Positively, Bumitama Agri surprised me with a (-$266 to $2,433) year over year, and Riverstone made a great comeback from (-$652 to $2,234) annually.

My REITs, what happened to them? They are the most important part of my portfolio, and I bought them because of their passive dividends. However, the prices of all of their stocks fell, with Yanlord Land falling the most. Total dividends paid out went down in 2024, even though the portfolio didn’t change. There’s nothing exciting or sad about the year 2024. Would it have been advantageous to dispose of Bumitama Agri and Riverstone during their peak periods in Q1 2025? It’s too late for that now that both have dropped; I really didn’t think of that.