So, I took a year off in 2023 and didn’t do much with my stock portfolio. I took dividends for the remainder of the year after selling off UG Healthcare Corporation. My portfolio was neglected, and I essentially went off the grid, resulting in a staggering loss of $10,000 by December.

- Sold UG Healthcare Corporation in Apr with -1k net loss (Buy: 0.205 Sell: 0.171)

- Due to the 5-7% yield, real estate still has the biggest market share.

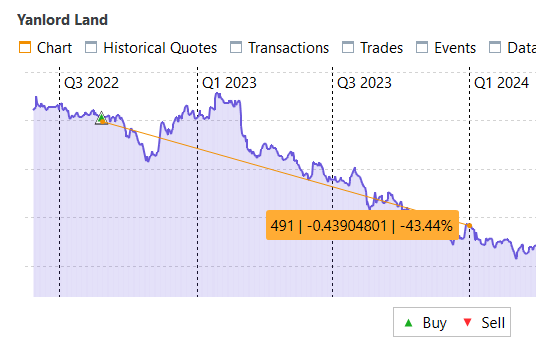

- The top three largest stock losses are Yanlord Land (-$4,927), Samudera Shipping Line (-2,615), and IREIT Global SGD (-1,965).

- Portfolio yield to market value = (6,403.37 / 73,842.90) x 100 ~ 8.67%

- Market value year 2022 to 2023 = (73,842.90 – 87,167.70) / 87,167.70 x 100 ~ -15.28%

- Dividend earned year 2022 to 2023 = (6,403.37 – 4,062.35) / 4,062.35 x 100 ~ +57.65%

My equity portfolio shrank for the first time. While only UG Healthcare stock was sold, the unrealized capital gain suffered a substantial loss, primarily due to Yanlord Land (-43.44%). My total dividend was insufficient to compensate for the unrealized loss, which was a dismal year. The lesson is that, even when creating a passive portfolio, it is still necessary to periodically review and make adjustments to the portfolio.