I tried purchasing stocks on the Singapore Exchange (SGX) in 2015 with UOB Kay Hian as my broker through its platform, UTRADE. Subsequently, I transitioned to Standard Chartered Bank online stock trading services as my custodian, albeit at a lower brokerage fee. BRC Asia, KSH, and DYNA-MAC are a few of the first stocks I purchased. Until 2020, I refrained from investing until I casually constructed a portfolio with my spare cash in less than two months.

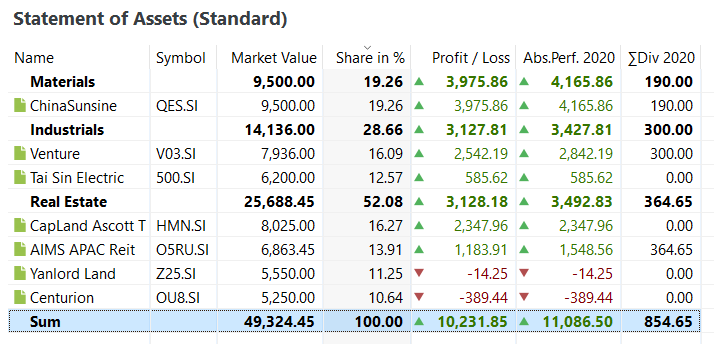

Portfolio as of Dec 2020

- Market value = SGD$49,324.45

- 52% in Real Estate, 29% in Industrials and 19% in Materials

- Unrealized capital gain ~ $10,231.85 (thanks to ChinaSunsine, Venture and CapLand Ascott)

- Total dividend received = $854.65

- Portfolio yield to market value = (854.65 / 49,325.45) x 100 ~ 1.73%

It was a sensible first step into the world of stock investing. I was 34 years old and had never invested in stocks before. I wasn’t serious and didn’t have any goals or a plan. Furthermore, I was also just a typical Singaporean who paid his yearly insurance premium, which included one or two long-term investments for my retirement plan. It feels good to finally be responsible for my money because I know what I want to do with my extra cash instead of putting it in the bank to earn 0.05% interest.